A Close Look at At-Risk Pay and the Purpose Behind Performance-Based Compensation

Discover why variable pay is a core driver of sales success.

Samuel Holzman

At-risk pay – it sounds a bit daunting, doesn’t it?

On the surface, associating the idea of risk with compensation might inspire a certain level of anxiety among employees. But as this article will show you, at-risk pay – when used correctly – is an effective staple of any successful sales organization.

What you’ll learn:

- What is at-risk pay?

- Types of at-risk pay?

- Advantages of at-risk pay

- Possible disadvantages of at-risk pay

- Communicating at-risk pay to employees

- Statistics and facts about at-risk pay

Motivate your reps with automated incentive pay

Discover the power of automating commissions with Incentive Compensation Management, and easily create incentive programs that scale.

What is at-risk pay?

At-risk pay is another way of referring to performance-based variable compensation that companies use to motivate employees. It’s used to incentivize performance, improve employee behavior, or keep team members engaged.

Commission is the most commonly used form of at-risk pay, though it can also refer to other types of incentives, such as bonuses, stock options, or spiffs (short-term bonuses tied to specific objectives). The idea behind at-risk pay is that it’s not guaranteed and requires certain performance targets to be met.

Types of at-risk pay

Here are a few of the most common types of at-risk pay that organizations offer to their employees.

Commission

Commission is an amount of money paid for the completion of certain tasks or the closing of deals. It’s used to incentivize sales professionals to be more productive and typically makes up a large portion or all of their pay. The total amount of commission that an individual earns is based on the compensation structure set in place by the organization and on the individual’s sales performance.

Bonuses

Bonuses are awarded based on a range of factors including individual performance, team performance, or even the entire organization’s performance. Organizations often pay out performance bonuses less frequently than sales commission – sometimes quarterly but most commonly at the end of the fiscal year.

Profit Sharing

Profit sharing is a common type of performance bonus – it’s just not tied to individual performance, but rather the financial performance of the organization as a whole. Most profit-sharing programs pay each employee a specific percentage of the organization’s profit. Profit sharing is intended to incentivize performance and teamwork across job functions, giving each individual contributor a stake in the company’s overall success.

Advantages of at-risk pay

At-risk pay is an effective lever for organizations that wish to motivate employees and improve performance. Here are some of its main advantages:

Boosts performance

Variable compensation encourages employees to strive for excellence in their daily tasks. When employees see that their hard work and effort are rewarded financially, they’re more likely to put in extra effort.

Creates accountability

Organizations that want to build a culture of accountability can benefit greatly from at-risk pay structures. They give employees tangible goals to strive for and reward them when they achieve those goals. Thus, at-risk pay often helps to create an environment where people take ownership of their actions.

Improves motivation

Financial incentives like at-risk pay reward employees for reaching goals or targets. It motivates them to consistently perform at a high level because they understand that they must do so in order to earn the maximum amount of money.

Reduces turnover

At-risk pay can also help reduce turnover rates, particularly in sales. It can be difficult for organizations to retain their most valuable team members, and costly for them to replace these top performers when they leave. Studies suggest that compensation is the top driver of employee turnover.

Possible disadvantages of at-risk pay

Although at-risk pay has its advantages, it also has its drawbacks in certain circumstances. The most commonly cited pitfalls include the following.

Creates high-stress work environments

The nature of at-risk pay may cause undue stress or pressure on employees. On the one hand, it motivates employees to perform at a high level. However, it can be incredibly stressful for an employee who falls behind on hitting their goals for one reason or another. This can lead to burnout and reduced productivity.

Dissuades collaboration and teamwork

When compensation is tied to individual performance, you may find that employees focus solely on their own goals. For this reason, at-risk pay can create an atmosphere where collaboration is implicitly discouraged. In a workplace where employees prioritize their own performance, you may find poor communication and cooperation across teams and departments – which can hurt an organization’s culture and overall results over time.

Incentivizes the wrong behaviors

At-risk pay is only as effective as the strategy behind it. If an organization isn’t careful and intentional in creating its compensation plans, it risks incentivizing the wrong behaviors.

For example, if a compensation plan has no controls in place to avoid selling to unqualified prospects, customer churn might increase; sales reps may close a number of deals with prospects who are bad fits for the product, just so they can earn their maximum commission.

Communicating at-risk pay to employees

Creating an effective compensation structure is only the beginning. It’s equally important to communicate your compensation structure to employees.

Too many organizations spend time and resources building their plans but fall short when it comes to clearly communicating the details and logic behind these plans to their reps. The lack of a communication strategy is a fatal flaw that can render even the most nuanced compensation plans useless.

When reps have to do the heavy lifting to figure out their compensation plan, they have less time to spend on sales activities. This confusion hinders productivity and undermines the primary goal of incentive compensation – motivating employees.

The only remedy is a formal incentive communication strategy. Developing a communication process for sales compensation can improve employee satisfaction, boost pay transparency, and relieve your reps of a massive administrative burden. Here are a few steps we recommend taking:

- Document your current sales compensation process.

- Outline a thorough communication plan for each step of the process.

- Document your compensation process’s purpose and expectations clearly.

- Test your communication tactics, collect feedback, and improve processes as you go.

Statistics and facts about at-risk pay

For context, here is some of the latest research related to at-risk pay and incentive compensation.

- 74% of organizations said their annual incentive plan was “moderate to effective” in achieving its objectives.

- 90% of top-performing companies use incentive programs to reward their sales associates.

- Properly structured incentive programs can increase employee performance by 44%.

Assess your approach to at-risk pay and continuously improve your compensation process

If your organization sells products of any kind, you likely already implement at least some form of at-risk pay. But incentive compensation only benefits organizations that use it correctly. Analyze the forms of at-risk pay you offer and the methods with which you deliver them. From there, you can make improvements and ensure your incentive compensation strategy is as effective as possible.

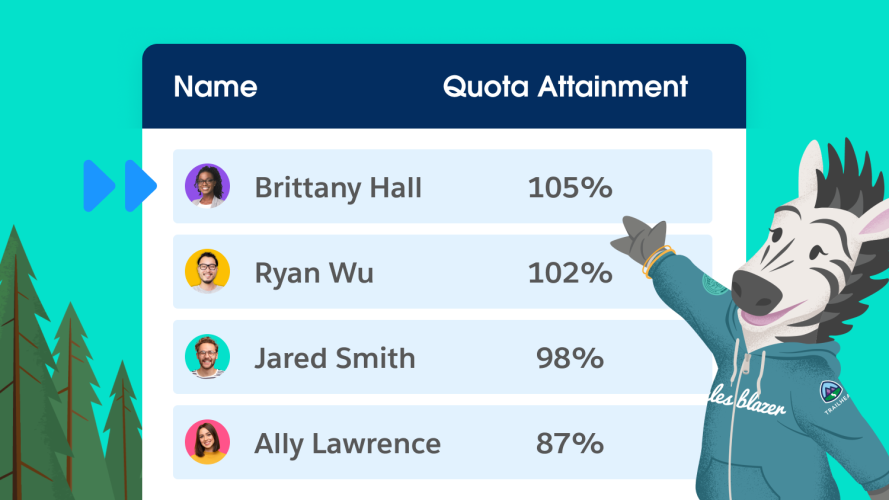

Attain quota faster and speed up sales ops

Learn how Sales Performance Management helps you connect customer data to sales planning and execution.